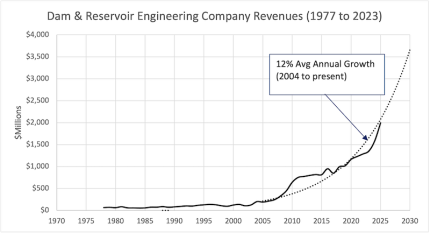

The dams market is busy. Very, very busy. Those of us working in this market are not surprised; the only surprise is just how busy we’ve been…and expect to be for many decades. For the last 20 years the dams and reservoirs market has averaged 12% year over year growth. In other words, beginning around 2004 this market has doubled every six years.

Monitoring and tracking the dams market was first initiated by the US Bureau of Economic Analysis (BEA) in 1977 and was simply reported as a contributor to the entire US Gross Domestic Product (GDP). If 10% of this GDP is assumed to be contributed by engineering firms, a picture of the engineering effort for dams and reservoir projects begins to emerge. The BEA stopped tracking this data in 1997, but quite fortuitously, the Engineering News Record (ENR) began publishing its Sourcebooks in 1998, including a category for dams and reservoirs.

The ENR data is very straightforward. Each year, US based engineering firms report their total revenues in six major markets – General Building, Transportation, Oil and Gas, Power, Environmental, and Manufacturing – and 67 submarkets within these broad categories. For example, the dams and reservoirs market is reported as a submarket of the Environmental category. When the revenues of the top firms working in this market are combined and tracked annually, long-term engineering revenue trends come even more into focus.

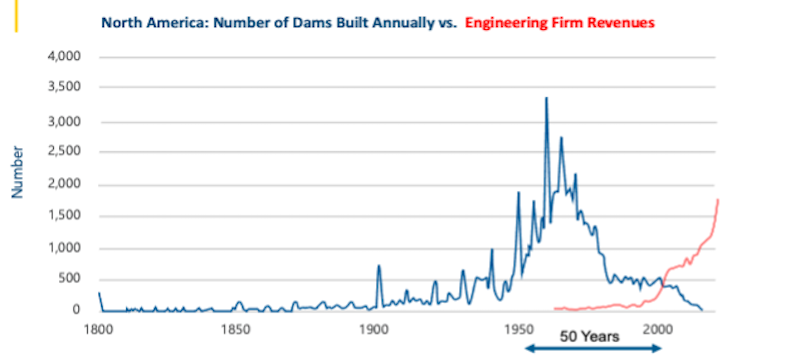

Combining the BEA and ENR data paints a fairly complete picture of US based engineering firms working on dams and reservoir projects over the last 47 years, which is shown in Figure 1. The solid line represents actual engineering annual revenue data as reported by the BEA and ENR.

AECOM is the one of the engineering firms working extensively in this market and has seen its dams and reservoirs revenues increase from $13.7 million in 1998 to $666.3 million in 2023, which is the largest annual revenues of any firm working in this market. This translates to an average annual increase of over 11%.

Dennis Hogan is AECOM’s global lead for dams and hydropower and believes this growth is due to several factors. “We’re seeing significant growth across all regions as well as globally. This is because of a renewed focus on infrastructure and climate resilience, and we’re seeing this on all continents,” said Hogan. “Dam owners are prioritizing critical infrastructure as they gain a better understanding of their risk and exposure. The sheer number, size, and complexity of these projects will be a challenge to study, design, and construct.”

Other consulting engineering firms are seeing similar impressive growth. Schnabel Engineering is a specialized engineering firm focused primarily on geotechnical, dam and tunnel services. It also is one of the few US engineering firms with a business unit dedicated solely to the dams market. Since it was established with eight professionals in 1994, this group has grown to 215 professionals and has seen its annual revenues swell from $1 million during its first year to over $58 million in 2023. Most impressively, the dams group now accounts for about half of the overall revenues of the company.

Michael Canino is the business unit president for Schnabel’s Dam and Levee Engineering Services (Strategy and Execution) and says he’s been fortunate to work within this group. “There is an abundance of new and existing dam and levee opportunities, particularly in the water supply, power generation, and flood control areas,” said Canino. “The adoption of risk-informed decision-making approaches over the last few decades has positively transformed the way many US federal agencies approach engineering analyses and design. And many states are now beginning to adopt similar approaches.”

Canino shares the concern of many others related to staffing. “Overall, the biggest challenge we’re seeing is finding enough experienced dam engineers and engineering geologists to outpace the rapid rate of retirements.”

As with the engineering revenues for dams and reservoirs, a dramatic increase in professional associations focused on dams and dam safety has also been occurring.

The United States Society on Dams (USSD), the US representative of the International Commission on Large Dams (ICOLD), has seen its membership surge from 980 in 2001 to over 1,600 in 2024. Its conference attendance has similarly increased, from 270 attendees in 2001 to 1,000 attendees in 2024.

Dina Hunt, current president of the USSD, has observed a steady increase in membership since joining the board of directors in 2019. “USSD’s growth mirrors trends in the dam industry and has been remarkable,” Hunt said. “Challenges such as climate change and more extreme weather patterns are putting increasing pressure on our water infrastructure, bringing heightened awareness to the importance of dams. This awareness is driving funding and keeping dam professionals hard at work.”

International market growth

Data is currently unknown for engineering firms working on dams and reservoirs outside of the US market, but one person who believes similar growth trends are occurring around the world is Mike Rogers. Mike is Stantec’s global technical practice leader for dams, and has formerly served as ICOLD’s vice president (Americas) and president, and has witnessed the global priorities of nations focus on adding renewable hydropower to meet the skyrocketing water and power needs of their populations and industries. Stantec has seen its annual revenues in the dams market surge from $25.5 million in 1998, to $171.3 million in 2023.

“Dams have been a cornerstone of nations for over 100 years for water, power and flood control,” Rogers said, “But their role in sustainable development of national water resources has never been a higher priority than in the last 10 to 20 years. Mature, industrialized nations are maintaining and extending the lives of existing dams and hydropower, and developing countries are racing to add new projects. These projects include small to massive structures and systems designed to manage resources for irrigation, expand water supply storage and extend power grids to ever-growing populations. We’re scrambling as an industry to continue creating safe and reliable dams, which are critical elements of our water infrastructure.”

Reasons for market expansion

The reasons for the rapid increase in this market appear to be multifold, and include water supply concerns and shifting hydrologic systems, aging infrastructure, and increased interest in renewable energy.

Water supply and shifting hydrologic systems

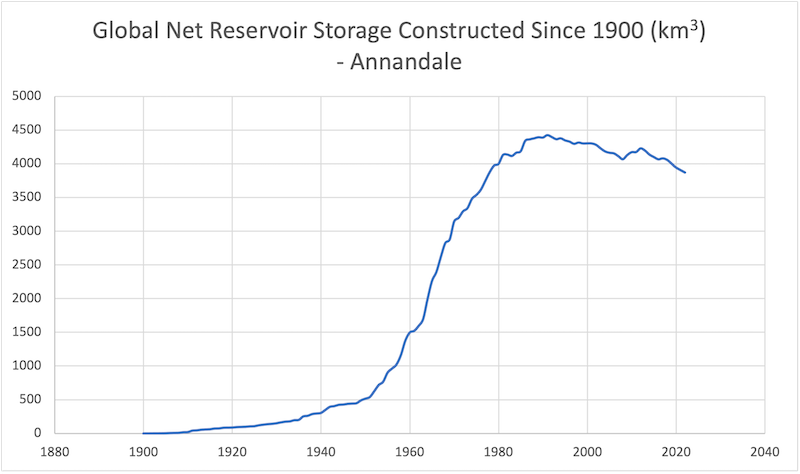

Dr. George Annandale, who has been monitoring global reservoir storage and sedimentation issues for decades, found that global water storage peaked in the 1980s and has been on the decline since this peak, which correlates to a dramatic slowdown in the construction of dams worldwide.

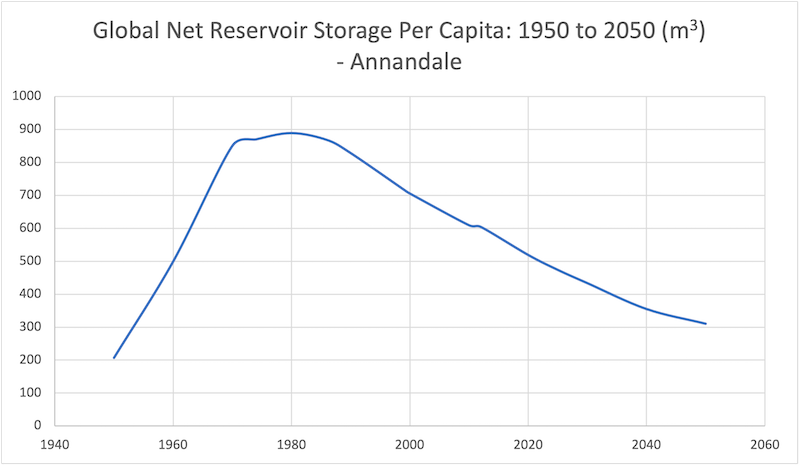

“Rivers have the greatest potential for sustainable development of freshwater resources, but hydrologic variability, which will increase in the future as the effects of climate change sets in, requires dams and reservoir to capture water during high flows for use during dry periods,” Annandale said. “The available global net storage is continually decreasing even with the construction of new dams. Globally, about 1% of reservoir storage is lost every year because of sedimentation, which is more storage than we’re currently adding through the construction of new dams. What is even more alarming, is that the combined effects of reservoir storage loss due to sedimentation and continued global population growth results in the amount of reservoir storage per person drastically decreasing on an annual basis. We’re now essentially in the same situation as we were in the 1960’s.”

Figure 2 shows global net reservoir storage as estimated by Annandale.

However, since the 1980’s the global population has nearly doubled, from around 4.5 billion to over 8.2 billion. At the same time, reservoirs have continued to infill with sediments. This double-edged sword has created a dramatic reduction in the per capita global net reservoir storage. The global per capita net reservoir storage peaked in 1980 at just under 900m3, and in 2023 it is estimated that this same storage is approximately 500m3. This is a reduction of almost 50% and likely the first time in modern human history where per capita reservoir storage has declined. If the current rate of decline continues, currently between 50m3 and 100m3 every 10 years, per capita reservoir storage will soon be at levels not seen since the 1950’s.

This trend is unsustainable and must be addressed in the form of additional storage. There is no substitute for water and its redundancy, especially when there are significant disruptions or threats to its supply, is a priority for all humanity.

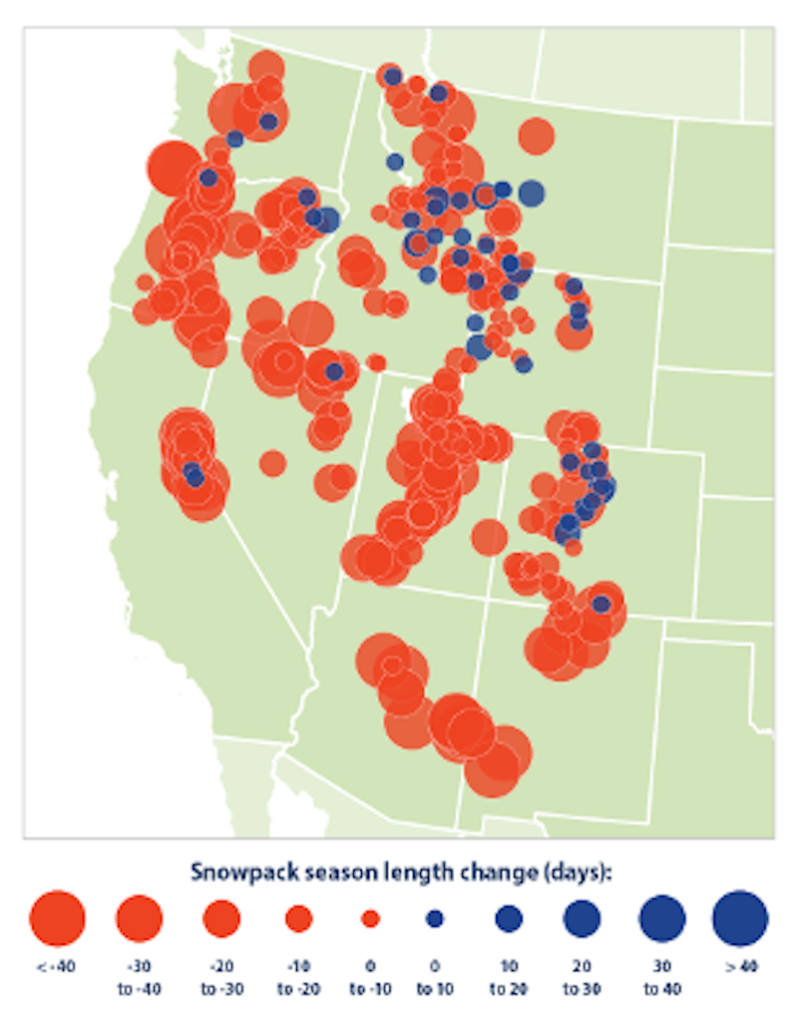

Hydrologic systems are also shifting. In the Western US, the hydrologic system, like many others around the world, relies on a simple cycle. The Western US hydrologic cycle begins with snowfall in the mountains during winter months, capturing this snowmelt during spring and summer months, and then distributing this water throughout the year until the cycle repeats. But this hydrologic cycle is being significantly disrupted.

As the atmosphere warms the snowpack in the Western US is rapidly declining. Figure 4, generated and published by the US Environmental Protection Agency (EPA), shows the reduction in the length of the snowpack season (measured in days) of the Western US states from 1955 to 2021. In the most significant areas, the snowpack season has reduced by over 40 days.

This reduction has severely stressed the water capture and distribution systems in the Western US. These systems were designed to capture snowmelt slowly over several months, but precipitable water is now beginning fall in the form of large rain events instead of snow. The water capture and distribution systems in the Western US, like many others throughout the world, will most likely have to be altered to adapt to these shifting hydrologic conditions to continue to operate effectively.

Aging infrastructure

The average age of a dam throughout the world is 60 years. The post-World War II building boom included a massive investment in dams and reservoirs to support the rapidly increasing population that was occurring. In the US, the dam construction boom peaked in the 1980s, when restrictive environmental permitting laws began to be implemented, and has been steadily declining ever since. Because of the immense cost and impact of dams, combined with difficulties in approvals for these projects, the use of existing reservoirs is being stretched to their maximum extent, but this lifecycle extension requires significant and ongoing maintenance and repair.

Figure 5 shows the number of dams built in the US since 1800 and compares this to dam and reservoir engineering revenues. At about 50 years after construction, the engineering effort on dams increases sharply. This is due to a range of factors, but the largest of these is age. The majority of dams were designed and constructed to 60-year-old standards and technology, many of which don’t exist today or are significantly outdated.

The 60-year average age of US dams correlates to the number of failures. Since 2008, the US Association of State Dam Safety Officials has documented an average of 20 dam failures and 50 dam safety incidents each year, where dramatic intervention prevented failures. Significant failures of aging dams continue to occur throughout the world, with several and recent and dramatic examples in the US, Libya, Norway, Sudan, Kenya and elsewhere.

Increased interest in renewable energy

Renewable energy sources are becoming increasingly vital to the global energy landscape. Hydropower, one of the oldest, most reliable and most efficient forms of renewable energy, continues to play a crucial role. The development of new hydropower, and the ongoing maintenance of existing assets, will continue to grow in future years. This includes the dams that create the reservoirs that power the turbines.

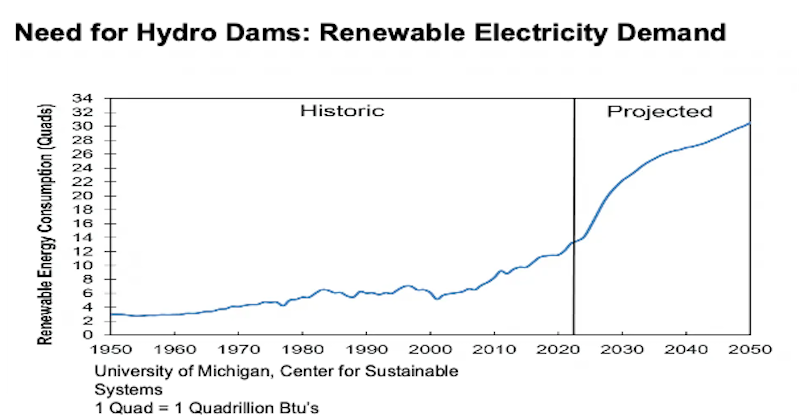

In 2022, the University of Michigan’s Center for Sustainable Systems estimated the demand for renewable sources of electricity would increase by over 250% over the next 25 years, which is shown in this graphic.

The International Energy Agency estimates that hydropower energy generates about 4,300 Terawatt hours (TWh) of energy each year, and if this were to increase as predicted, we would need to add nearly 6,500 TWh of new hydropower generation throughout the world.

The future of the dams and hydropower market

Even with extensive data and other relevant information, predicting the future with a high degree of accuracy is never assured – and any predictions should always come with caution. However, if current trends continue and are supported by the discussed market drivers, the recent and impressive growth of the dams, reservoirs and hydropower markets should similarly continue to increase. The data from the US appears to be a barometer of the overall market worldwide. If the average annual growth rate of 12% that has been experienced since 2004 continues, it may drive an unsustainable shortage of experts who work on these complex and challenging projects. With this in mind, it is important to raise awareness of the future professional resources that are needed to ensure our dams, reservoirs and hydropower assets remain in place for the communities they serve.

Investing in our water infrastructure is crucial for ensuring sustainability. By prioritizing the maintenance and expansion of dams, reservoirs and hydropower assets, we can support communities and industries that rely on these fundamental, imperative resources. This strategic investment will help secure water supply, enhance energy production and contribute to a more prosperous and stable future.