How can advanced simulations and digital twins be utilized in hydropower operations to optimize investment decisions?

When considering how advanced simulations and digital twins can support investment decisions, we typically focus on three key use cases:

1. Portfolio optimization: This involves evaluating investments within an existing portfolio, such as replacing or adding a turbine, increasing pump capacity, or installing remote controls for gates. For instance, if I already have a hydropower plant, I may consider these upgrades to enhance its performance.

2. Mergers and acquisitions (M&A): This scenario involves assessing the acquisition of additional hydropower assets. Here, the goal is to evaluate potential new assets that are not yet owned, requiring first-hand data to make informed decisions. Often, this data must come from simulations because the actual operational data isn’t directly accessible.

3. Regulatory changes: These are situations where regulatory authorities propose or implement new rules, such as changes to concessions. Simulations are used to understand the financial and operational impacts of these changes under current and potential future conditions.

What ties these scenarios together is the need for robust, first-hand data to make data-driven decisions. Simulations help provide this by creating realistic projections based on current and hypothetical conditions.

Regarding digital twins: a digital twin of a hydropower plant is an advanced tool that allows operators to simulate potential scenarios as if the changes (e.g., new turbines or regulatory constraints) had already been implemented. This enables comparisons between the existing and proposed setups under identical conditions. For example, simulations are performed using the same time window, inflows, and pricing to ensure accurate and actionable insights. In M&A scenarios, digital twins offer an objective, data-driven assessment of potential energy production and revenue generation for the asset under various operational modes.

What are the key metrics or outputs that these simulations generate to guide decision-making?

Hydropower simulations, such as those offered by HYDROGRID Insight, produce detailed metrics and key performance indicators (KPIs) to guide investment decisions.

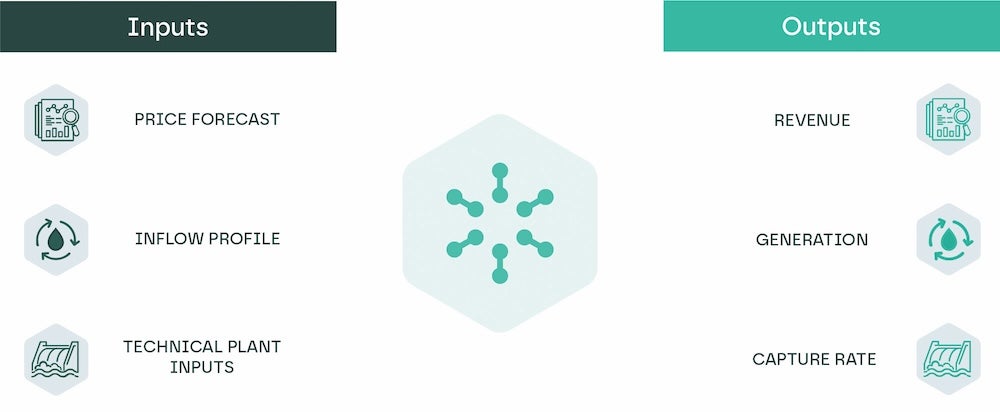

The primary outputs include:

• Energy production: Detailed projections of the energy that could be generated under various scenarios.

• Revenue generation: Estimates of the revenue tied to different levels of energy production and market conditions.

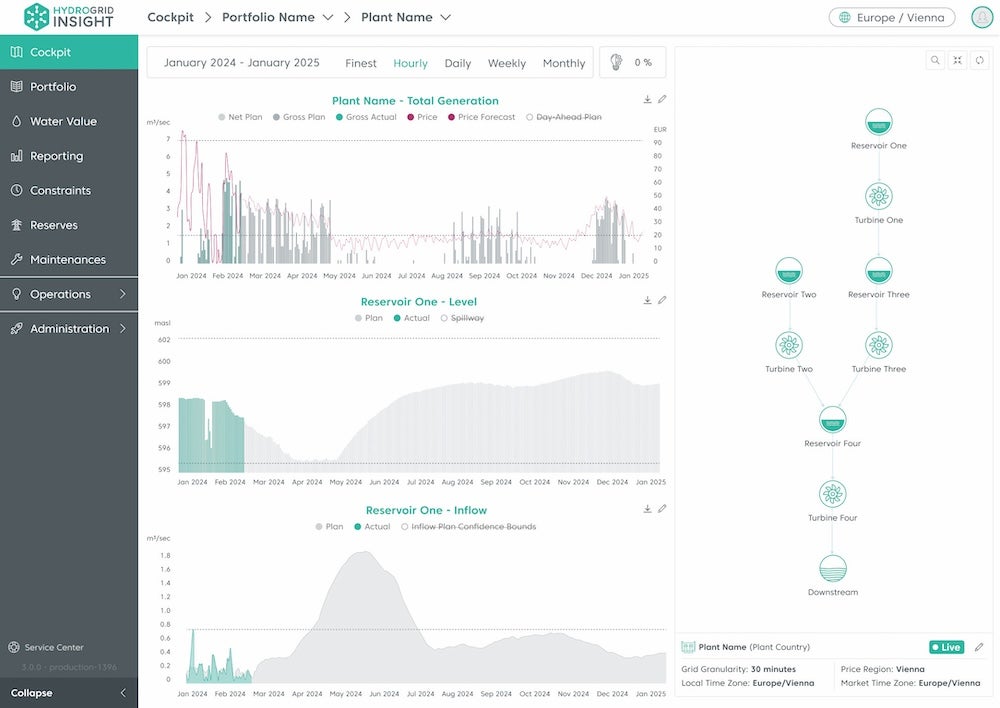

• Operational details: High-granularity data calculated at the hourly level and aggregated over days, months, and years.

• Comparative analysis: Metrics comparing the performance of current and simulated scenarios.

These outputs allow operators to deeply analyse both high-level trends and granular details, ensuring their decisions are thoroughly informed by data.

How does the system account for uncertainties such as climate variability, weather, or regulatory changes?

The system uses two approaches:

1. Configurable constraints: HYDROGRID Insight enables operators to set and adjust parameters like minimum discharge, ramping requirements, and reservoir levels for each simulation. This flexibility allows users to model a wide range of regulatory scenarios.

2. Climate data integration: Simulations incorporate real-world climate data, such as rainfall, snowmelt, and inflows, to reflect local weather variability. To account for seasonal patterns and other climate-related nuances, the system runs simulations over extended time windows to capture these dynamics effectively.

For example, a recent case involved a Norwegian operator assessing the feasibility of adding a turbine to an existing plant. By simulating the plant’s operation with the new turbine over three years (from early 2022 to late 2024), the system provided detailed outputs on energy generation, revenue, and operational performance. The analysis showed a potential revenue increase of over 10%, giving the operator a clear understanding of the investment’s return and break-even timeline.

Hydropower investment simulations are rarely a one-time exercise. Operators often have portfolios of multiple plants and continuously assess new opportunities or changes. As a Software-as-a-Service (SaaS) solution, HYDROGRID Insight provides recurring simulation capabilities, enabling

customers to:

• Regularly evaluate upgrades or new investments.

• Analyze different operational scenarios.

• Make informed decisions on future strategies.

Operators typically purchase packages that include a set number of simulations over a defined period, ensuring they can continuously adapt to changing conditions and opportunities.

Can you provide an overview of the HYDROGRID platform? What makes it unique in the market?

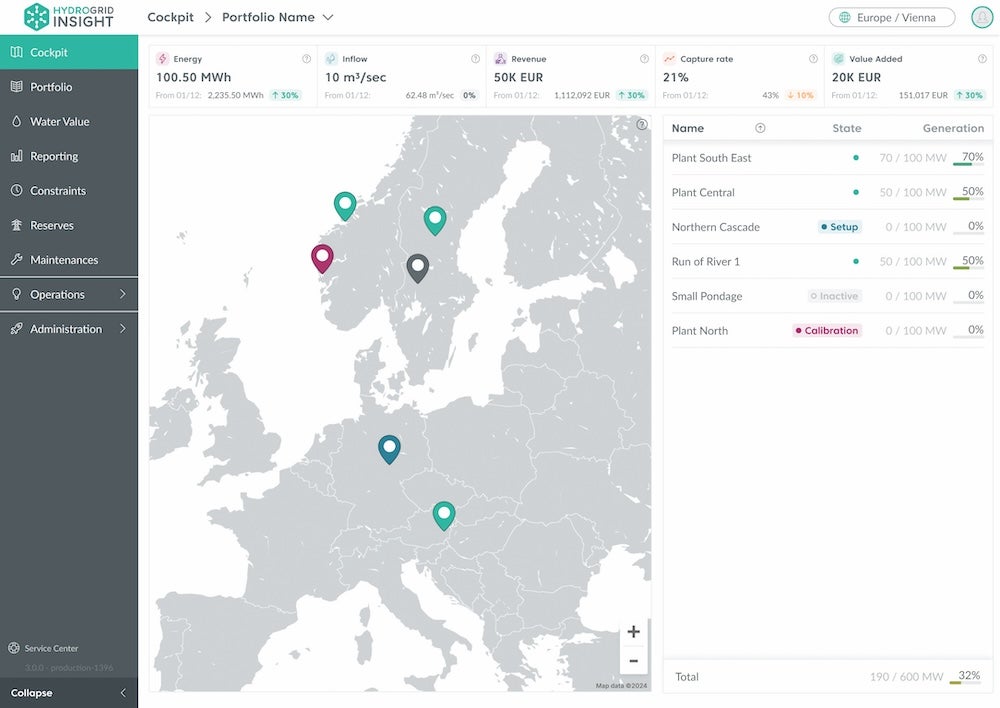

HYDROGRID Insight is a comprehensive digital water management and production planning platform designed to optimize the operation of hydropower plants. It provides a fully integrated solution for hydropower operators, streamlining operations in one central location. The platform offers a holistic approach to water management, allowing operators to manage inflow forecasting, short-, medium-, and long-term dispatch planning, as well as automate the handling of environmental and regulatory requirements.

Additionally, HYDROGRID Insight also covers maintenance planning. The key to its uniqueness is the real-time, fully digitalized experience it offers, enabling decision-makers to easily access all the necessary data and optimize their operations, all in one place.

How does the platform contribute to improving operational decision-making for hydropower operators?

HYDROGRID Insight supports hydropower operators by enhancing their operational efficiency through a multi-layered approach.

1. Day-to-day operations: The platform helps improve technical efficiency by reducing water spill and optimizing turbine use. This leads to more electricity production without needing any changes to the physical plant, all driven by advanced analytics and data. Operators can access optimized production plans or manually override them, but the system provides the necessary insights and data for informed decisions.

2. Revenue optimization: In liberalized markets, electricity prices fluctuate, and HYDROGRID Insight integrates with stock exchanges and price forecasting to ensure plants produce electricity at the most profitable times. Operators can optimize production based on flexibility, increasing revenue by up to 15%, with some customers experiencing as much as 50% higher revenues compared to previous methods.

3. Maintenance planning: Maintenance is crucial to extend the lifespan of hydropower plants, but it can reduce plant capacity temporarily. HYDROGRID Insight offers a maintenance planning feature, helping operators choose the optimal time for maintenance while minimizing the financial impact. The system generates recommendations, including estimated revenue changes for different maintenance windows, using the same high-resolution data used for production planning, ensuring consistency in decision-making.

4. Investment decision simulation: When considering plant upgrades or investments, HYDROGRID Insight provides data-driven simulations that help operators make informed decisions regarding investments in plant infrastructure, optimizing the long-term viability and performance of the plant.

What types of users within an organization typically interact with your platform?

HYDROGRID Insight is designed to be used across different roles within the organization, with each user benefiting from the platform’s unique features.

• Production planners: These users benefit from forecasting tools, generation planning, and adherence to environmental regulations, both short- and long-term.

• Technicians: The maintenance planning feature is crucial for technicians, allowing them to optimize maintenance schedules and reduce downtime.

• Traders: Traders focus on water value across the fleet, using the platform to assess marginal prices and optimize bidding strategies.

• Financial decision makers (consultants, project developers, turbine manufacturers, and hydro O&Ms): these type of roles use HYDROGRID Insight’s investment simulation tools and dashboards to track financial performance,

assess financial feasibility, optimize project planning, and support long-term investment strategies.

HYDROGRID Insight is accessible via a responsive website, meaning it can be used across a range of devices, including mobile phones and tablets. While the platform works on any device, it is optimized for larger screens due to the heavy use of data visualizations. On smaller screens, users may see a condensed view of the information, but it still functions seamlessly.

For the best experience, users are encouraged to access the platform on larger devices for an optimal interface, as the detailed dashboards and full plant overview are easier to navigate.

How is machine learning applied within HYDROGRID’s solutions to enhance forecasting accuracy?

Machine learning is a powerful tool for uncovering correlations within data and predicting their effects. Its advantage lies in the ability to learn from data without the need for painstakingly simulating every process or creating explicit physical models, which can often be too complex to maintain. A prime example of this in HYDROGRID Insight is our inflow forecasting. Traditionally, inflow predictions would require detailed physical models of the landscape, water flow, and storage dynamics, but machine learning allows us to bypass these complexities.

Instead, the system relies on available data – such as weather forecasts, rainfall, and historical inflow measurements – and the machine learning model identifies patterns and learns how past weather conditions influenced water levels and flow into the plant. It can then predict future inflows based on this historical data, without needing to model the physical landscape at all. This approach provides a more efficient and scalable solution to forecasting.

What challenges have you faced in integrating machine learning into hydropower operations, and how have you overcome them?

Integrating machine learning models can be challenging, especially when the required data is sparse or inconsistent. One of the main challenges is that the more complex and powerful the model, the more data it requires to train effectively. In simpler terms, the better the model, the more “feeding” it needs to develop – just like how more intelligent species tend to take longer to mature and require more nourishment and experiences during development.

To overcome this, it’s crucial to understand the typical data that operators have access to and choose the models accordingly. Not all hydropower plants have the advanced sensors or telemetry data, and this variability can impact a model’s performance. HYDROGRID Insight’s dedicated analytics team plays a key role in building these models to work with the customer’s specific data. They ensure that the models remain powerful yet practical for real-world applications, providing operators with accurate insights and predictions despite limitations in data availability.

How does your platform address inflow forecasting and incorporate these forecasts into operational planning?

HYDROGRID Insight uses advanced signal processing and machine learning techniques to model inflow forecasting, turning it into a data-driven prediction problem. The generated inflow forecast is not just a black box – it’s displayed to users in a transparent manner so that they can understand and trust the forecast. This transparency builds confidence in the system and gives operators control over the decision-making process.

The inflow forecast is then used as a core input to generate the optimized operational plan, ensuring that the plant operates efficiently according to forecasted water levels. This planning is dynamic, taking into account both current and predicted conditions to maximize energy production while adhering to constraints. Our platform works with customers across various climates – from continental to tropical regions – adapting the forecasting model to suit each environment’s unique characteristics.

What tools or methodologies do you use to balance competing constraints like environmental regulations, energy production targets, and financial objectives?

HYDROGRID Insight ensures that production plans are created with a clear hierarchy of priorities: environmental regulations take precedence, followed by energy production targets, and then financial objectives. However, the system also offers flexibility for operators to adjust these priorities based on specific situations. For instance, in a liberalized market where electricity prices spike, an operator may choose to adjust production targets to capitalize on high prices, potentially relaxing certain constraints.

Moreover, the system supports intraday optimization to handle real-time adjustments. After submitting a bid, an operator has committed to a certain plan, but reality may differ slightly from forecasts (e.g., rain may be heavier or lighter than expected). The system tries to stick to the originally committed plan as much as possible to avoid penalties, while using reservoir flexibility or adjusting gate positions to accommodate variations in water inflow.

Can you discuss how reporting features in your platform help operators track performance and compliance in real time?

HYDROGRID Insight provides a dedicated dashboard where operators can track key metrics such as energy production, water usage, inflow levels, and optimized versus unoptimized revenue. This real-time monitoring gives operators a clear view of the plant’s current performance.

The system offers both optimized and unoptimized generation plans, allowing operators to compare actual performance with the optimal plan suggested by the system. This insight helps operators identify areas where efficiency could be improved or where adjustments may be needed. Additionally, the platform allows operators to aggregate data over different time periods (e.g., weekly, monthly, yearly) and customize the reports to suit their needs. This flexibility helps operators stay on top of their plant’s performance and compliance with environmental and regulatory standards.

How does HYDROGRID approach long-term planning versus day-to-day operational decision-making?

Our approach follows a progressive timeline, starting from long-term to short-term. It’s important to note that HYDROGRID Insight is real-time, and all computations are designed to be highly efficient. We begin by establishing an effective long-term strategy that focuses on key developments for a timeframe of up to three years. This strategy informs short-term operations, which are then optimized in detail based on real-time data.

The process includes a progressive refinement approach. For example, while we focus on major development plans for the long term, short-term adjustments and optimizations consider more granular constraints and inputs. The long-term plan provides the direction, but short-term operations will adapt if needed, ensuring we stay responsive to real-time changes.

How do you see the role of AI and digitalization evolving in the hydropower sector over the next few years?

AI and digitalization are becoming indispensable for hydropower operators, especially amid evolving market dynamics shaped by energy market liberalization and the growth of solar and wind energy. These technologies go hand in hand, and operators must embrace them to remain competitive. As solar and wind energy production increases, data-driven decision-making and quick reaction times will be essential – partly due to the highly variable nature of these energy sources.

For this, AI plays a vital role as a tool for automation, helping operators make informed decisions faster. But equally important is having all the necessary data in one centralized, easily accessible platform. By leveraging AI to process and act on this data, operators can ensure swift responses and even reduce the need for 24/7 operational monitoring. The human operator remains in control, but AI supports decision-making and helps reduce the workload.

What sets HYDROGRID apart from other players in the market when it comes to leveraging data for operational excellence?

HYDROGRID differentiates itself by offering an integrated data platform that consolidates all relevant operational data. Unlike the common practice of using spreadsheets and manual calculations or more advanced, yet siloed systems, our platform ensures that data is accessible for analysis, optimization, and real-time decision-making. All computations and optimizations are done using data directly from this platform, eliminating the need for multiple disconnected systems.

Our platform supports seamless integration with the operator’s IT systems. The preferred method is through real-time system integration using standardized APIs (a modern computer-to-computer interface), enabling automated communication between systems. For operators without immediate access to IT resources, we also offer a manual integration option through Excel, ensuring that they can still begin using HYDROGRID Insight and access its full functionality. This flexibility allows for faster implementation while maintaining a high level of system integration and optimization.

Are there any specific partnerships or collaborations that have enhanced the development of HYDROGRID solutions?

Yes, several key collaborations have played a crucial role in shaping HYDROGRID’s development. One example is our partnership with SSE, which inspired the creation of the maintenance timing optimization feature. This collaboration, along with feedback from many other customers, played a pivotal role in shaping our product roadmap.

Another exciting area we’re seeing growth in is pumped storage. With the increasing reliance on solar and wind power, storage solutions are becoming critical, and we are responding to growing demand for solutions in this space. We’ve received strong customer interest in pumped storage development, and we’re already actively working on this as well. We expect to launch this feature in the first half of this year, in response to regulatory changes and increasing storage needs in the market.